Summary

The short and long term effects of the pandemic on the car industry are going to be disastrous.

The car industry is likely to be hit much worse than other parts of the economy – and this is NOT priced in already.

I will show you why the car industry will continue to be affected by the COVID-19 pandemic even after the pandemic has been overcome.

I recommend selling your car-related stocks.

Lately, the economy has been in turmoil. No sector is being spared in this downturn due to the COVID-19 pandemic. Major economic shutdowns like those happening now are almost unprecedented and are leading to disastrous performance of stocks across the board. In this article, I will argue why a single sector – the car industry – is going to be hit by this global pandemic more than other sectors, and in a more long-lasting way. I will also show that this is not priced in at the moment. I will show this using 3 main arguments.

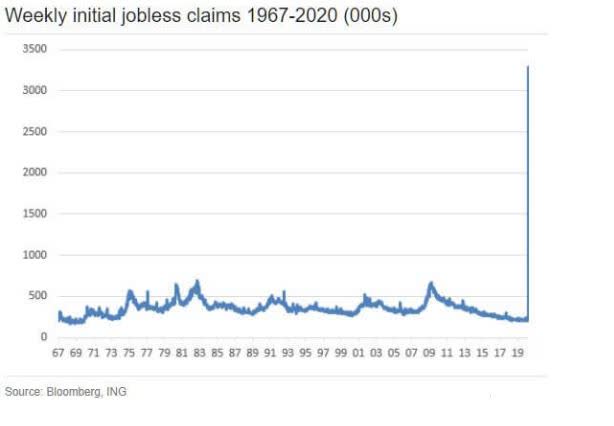

It is generally accepted that car sales are usually solid in a flourishing economy and bad as the economy turns sour. Of course, the car industry has always been a relatively volatile one, which means that one would expect car producers to take a major hit when a crisis like this happens. One of the main indicators which can predict how bad it is going to be is the weekly initial jobless claims, which has skyrocketed lately:

If people lose their jobs, the first spending they will probably cut is their discretionary spending, such as luxury items, holidays, and new vehicles.

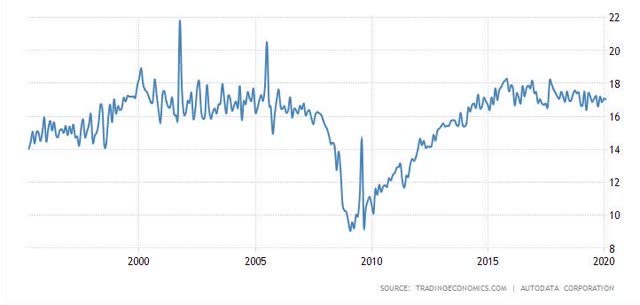

The general theory is that over time, demand for cars will likely be restored, or such as it was after the previous economic crises. Let us take a look at the demand for vehicles in the world’s two main economies: China and the US:

US car sales (in million per month)

US car sales (in million per month)

As you can see, vehicle demand in the US during the great recession of 2008-2009 dropped by about 50%. In China, this crisis is barely noticeable in the chart because car sales continued to grow quickly after this. If you look closer, you can argue that car sales also dropped during this period though they peaked just before.

But more interestingly, the first 2020 data from China has already been used in this graph, and it is devastating:

Vehicles sales in China tumbled 79 percent from a year ago to 310,000 units in February 2020, the steepest yearly decline on record, as the coronavirus outbreak hurt demand. Sales of new energy vehicles (NEVs), including plug-in hybrids, battery-only electric vehicles and those powered by hydrogen fuel cells fell for an eighth straight month. The China Association of Automobile Manufacturers (CAAM) expects that vehicles sales will decrease by more than 10 percent in the first half of the year, and around 5 percent in 2020 full year, if the outbreak is effectively contained before April. Vehicle sales will return to normal in the third quarter. Meanwhile, automakers in China have called for cuts to the purchase tax on smaller vehicles, measures to support sales in rural markets and an easing of car emission requirements (source: tradingeconomics)

So we can already conclude that Chinese vehicle sales slowdown is more severe than in 2008-2009. Of course, it is not fair to extrapolate these numbers to US or European data. Because as it looks like now, China was hurt badly by the COVID-19 pandemic, but there is every reason to believe that the US will be hit ever worse by this crisis. I would not be surprised if car sales data of the US will prove to be worse than the Chinese data.

Perhaps never before in modern history have so many people worked from home. Forced by lockdowns or shelter-in-place by ever more countries, companies are finding ways to allow their employees to work from home.

Of course, this sudden increase in people working from home has internet providers and corporate networks pressures to the maximum. But it looks increasingly like the situation will not go back to how it was: many employees who are now working from home are already starting to question why they needed to go in to the office in the first place. Some interesting quotes from over the internet related to the surge in working from home:

In Seattle, the hub of many of America’s early Covid-19 cases, companies including Amazon, LinkedIn, Microsoft and Google advised workers to stop coming in to the office in late February. In early March, Twitter “strongly advised” all its employees worldwide to do the same, and on Wednesday, made it compulsory. (source: The Guardian)

This might also offer an opportunity for many companies to finally build a culture that allows long-overdue work flexibility. Millions of people will get the chance to experience days without long commutes, or the harsh inflexibility of not being able to stay close to home when a family member is sick. (source: ma.tt)

“We’ll never probably be the same ..... People who were reticent to work remotely will find that they really thrive that way. Managers who didn’t think they could manage teams that were remote will have a different perspective. I do think we won’t go back.” (source: Buzzfeed)

I concur with most of the above statements. Even if many workers will go back to their physical workplace after the shutdowns are lifted, there will be many people who will continue to work from home more than they did before. It is very difficult to predict how this will turn out in the end, maybe two days in the office, three days from home will become the norm after a while? It often takes a crisis like this one to get major cultural shifts going. I believe this is one of the large cultural shifts which we will see taking shape as a result of the COVID-19 pandemic.

Of course, people will still want to own cars. But if fewer cars are used for daily commutes, people are likely to buy cheaper cars since they are not using them as often. Also, people might postpone a car replacement, seeing it as less essential. Even after the lockdowns will be gone and the economic crisis is over (these two will not go hand in hand), car manufacturers will feel the results of COVID-19.

One of the most promising developments in the car industry is the development of electric vehicles (EVs). There have been a couple of main reasons why this development is so promising: sustainability, efficiency, and cheap cost of usage, since charging up your battery with electricity is usually cheaper than fueling up your car with petrol. The drop in the oil prices is actually likely to be very bad for EVs. People interested in buying an EV might put this investment off for some time, not only because of the current state of the economy but also because of the enormous drop in oil prices, making it more attractive to keep driving old gasoline cars for a while longer.